In order to understand (with data) what happened in the NFTs market during 2021, we will try to answer a few questions:

- What are the main attributes of NFTs?

- What type of NFTs were the most expensive in 2021?

- What are the main figures to understand the NFTs market?

- Is it possible to establish a buyers profile for NFTs?

- Why do I think NFts are a promising market for native digital artists (and others)?

- Conclusion: What impact will have the NFTs market on the global online artworks market?

1- What make NFTs so special?

- An NFT is a digital asset, which is provably unique.

- They facilitate the trade of 100% authentic and original ownership of digital assets.

- NFTs could bring transparency to the art market which it currently lacks.

- NFTs can have many different forms: GIF’s, audio, video, tweets, virtual real estate, in-game collectibles.

- They are powered by the Ethereum (and a few other) blockchain(s).

- NFTs are the ideal media for native digital artists who usually have difficulties to set up exhibitions in traditional galleries and museums.

- Total NFT volume traded in 2021 stood at $8.8 billion with 60% coming from trading Art and Collectibles and the remaining 40% from gaming NFTs.

2- What are the similarities between the most expensive NFTs sold in 2021?

My analysis suggests that the most expensive NFTs sold since March 2021 are «moments» in the history of the Internet and for some people, in the history of art:

A good example is the most expensive NFT sold so far, created by the artist Beeple (Mike Winkelmann), called «Everydays: the 5000 first days». As its name indicates, this artwork is composed by 5000 images of his daily work during the first 13 years he has created NFTs.

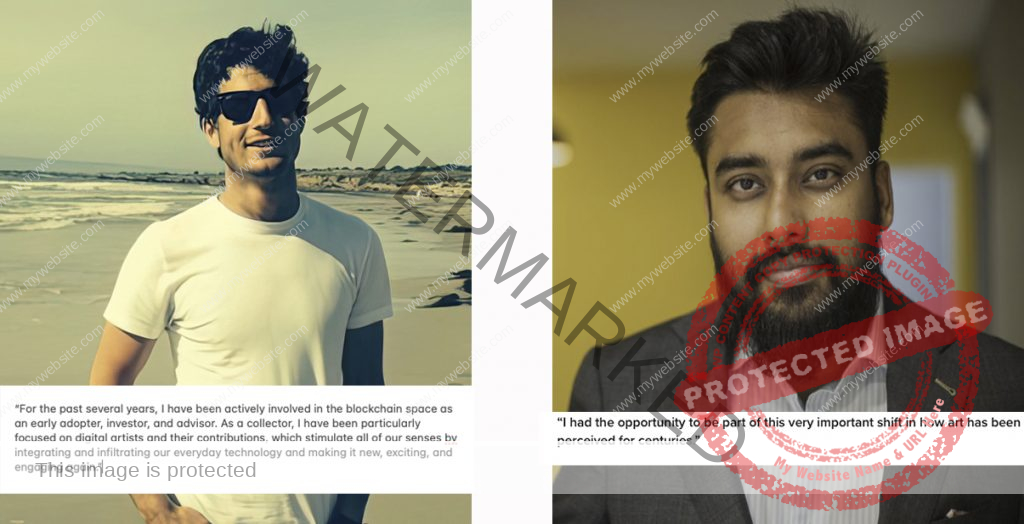

The interesting point here is the comment from the buyer of this NFT, Vignesh Sundaresan, who says he was willing to pay more than $69 million for this work because for him, it’s a turning point in the history of art: «I’ve had the opportunity to be part of a very important change about how art has been perceived for centuries.»

Within this category of «important moments,» we can highlight the Source Code for the World Wide Web ($5.4 million), the first Tweet by Jack Dorsey ($2.9 million), but also the videos of NBA top shots, or the Cryptopunks collection launched in 2017 by Larvalab, the oldest NFT collection ever created. (A Cryptopunk, which was given for free to the first gamers, has been sold in June 2021 by Sotheby’s for $11.8 million.)

3- What are the figures of the NFTs market?

In 2020, NFTs were sold for a total value of $33 million.

By 2021, the total sales have risen to $8.8 trillion (60% are artworks and collectibles, like the NBA Topshots and 40% are video game characters and accessories).

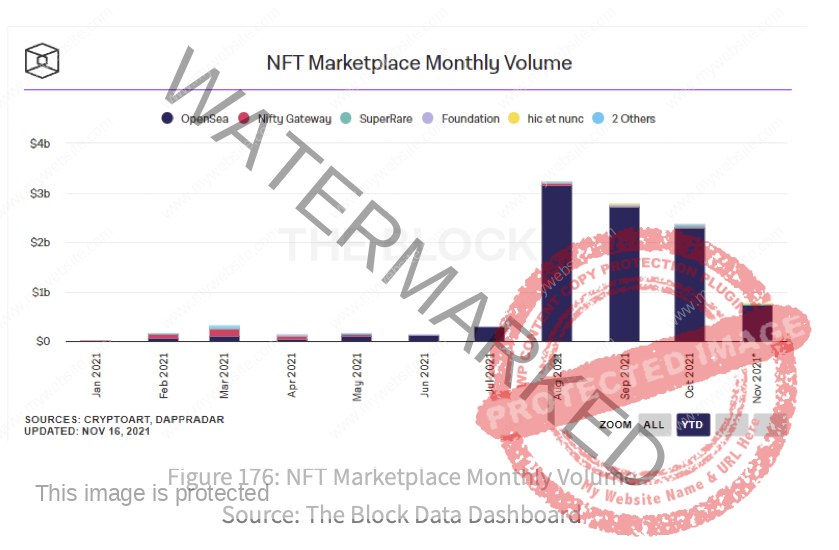

Today there are a dozen of platforms selling NFTs like Opensea, Rarible, Mintable, Nifty Gateway, SuperRare, Hic et Nunc, Fundation or Artblocks working on the Ethereum blockchain and few others, like Magic Eden and Solanart, working on the Solana Blockchain.

In 2021, Opensea clearly dominates the market with 88% of the NFTs transactions.

Although sales volumes have dropped regularly between August and November 2021, January 2022 was the second-highest-selling month in its history for Opensea, with more than $3 trillion.

4- The million-dollar question: Who buys NFTs?

To understand the tremendous success of NFTs, we have to understand who buys this type of digital asset inserted in the blockchain and why it seems easy and natural for them to do so.

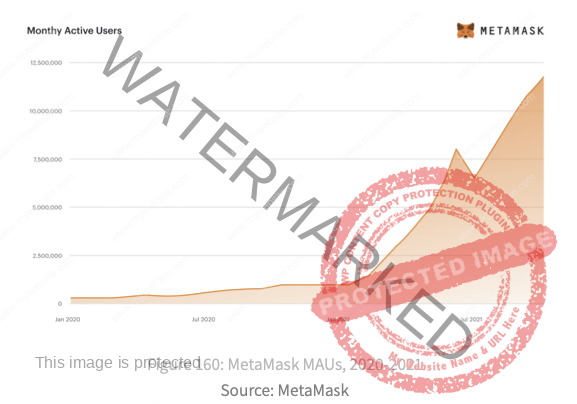

As we can see in this chart, the number of active digital wallets (needed to buy and sell NFTs) has increased almost tenfold between January and November 2021.

As we will not be able to analyze all the NFTs buyers one by one, let’s look closely to the case of 2 buyers and try to deduce if there is a specific profile of collectors for these intangible digital artworks.

One of these collectors is Vignesh Sundaresan, the buyer of the most expensive NFT in history (so far). The other is called Pablo Rodríguez-Fraile, he comes from a family of private bankers and he defines himself, as «the greatest NFTs collector «. His collection is one of the most important in the world, with more than 400 NFTs of the more relevant artists.

What do they have in common? Both are «Early Adopters», meaning they have invested in cryptocurrencies for a long time and have made money with them using trading platforms: Vignesh says that he has invested in crypto in 2013 and has set up several companies in this market, and Pablo since 2016.

But are they an exception? Apparently not: according to the CNBC, there is a new generation of millionaires between 25 to 40 years (generation Y) which 82% have invested in cryptocurrencies. They know the blockchain technology and, therefore, the NFTs and their potential as investment.

5- Why do I think NFts are a promising market for native digital artists (and others)?

In order to determine the potential of a market, a large number of factors must be taken into account, such as the robustness of the technology that aims to make it evolve, the endemic problems of this market and the evolution of consumer tastes, among others.

The art market is one of the last to be digitized and so far, the resistance to changes is huge, but the pandemic has accelerated this process. During the last year, online sales of artworks increased 2-fold, from 9% of the total market value in 2019 to 25% in 2020.

Even so, the art market is still very opaque: a handful of prestigious galleries and auction houses share millionaire sales, leaving very little space and resources for new entrants.

Blockchain technology (which allows the creation of NFTs) could solve a large number of problems of the art market, from the authentication of the artwork, the transparency in the successive sales prices of a piece, to the remuneration of the artist when the work is sold on the secondary market and the transport.

As we have seen previously, there are a lot of customers for NFTs : a new generation of collectors with high purchasing level that is used to buy and sell cryptocurrencies on online platforms. One way to measure the enthusiasm of collectors, is to observe the increasing number of Metamask wallets, necessary to buy and sell NFTs:

According to the «Art Basel and UBS Global Art Market Report«, in 2020 it has been sold artworks online for a total value of $12.4 billion, without taking in account the NFTs.

According to The Block Research 2022 report in 2021, it has been sold NFTs online for a total value of $8.8 trillion.

=> So, is it possible that the brand new NFTs market was in 2021 as big as 70% of the online «traditional» artworks market in 2020?

6- Conclusion: what impact will have the NFTs market on the online artworks market?

It is likely that the NFTs market will help to accelerate the digitization of the art market in general, offering great opportunities to digital native artists who before 2021 did not have a clear target audience.

It is also likely that galleries will quickly realize the opportunity the NFTs market represents and will push well-known non-native digital artists to take this opportunity, gradually offering more transparency to the art market in general.

If you liked this post, it’s possible you will enjoy my new one about «what could we expect for the NFTs market in 2022«?