In order to understand what could happen in the NFT market during 2022, we will analyze 6 trends that appeared since the second semester of 2021:

- Arrival of specialized NFTs platforms for different kinds of artistic projects

- Coming of recognized contemporary artists who see the opportunity and decide to enter the NFTs market

- Emergence of NFTs platforms curated by traditional galleries?

- Surfacing of new NFTs platforms not powered by Ethereum

- Conclusion: in 2022, NFTs will continue leveling the art market, allowing the emergence of new creators?

1- Emergence of specialized NFTs platforms for different kind of artistic projects:

As seen in my previous post “6 insights to understand what has happened with NFTs in 2021”, we can split the NFTs market in 3 main categories: those related to Gaming (like Star Atlas), those related to collectibles (like NBA Topshots) and those related to Art. In this part, we will focus on the NFTs related to art exploring what happened by the end of 2021 and what could happen in 2022:

The first NFTs platforms that have been created, like Opensea (2017) and SuperRare (2018), allows anybody that wants to upload an image to create an NFT. These platforms aim to attract more artists, NFTs and buyers than others in order to grow quickly. That’s the good strategy to enter a new market.

The dilemma between quantity and quality appears 3 or 4 years later, when the market is somewhat more mature. In 2021 appeared the first NFTs platforms that make a selection of their artists. What is really interesting here, is that each platform do it using different criteria:

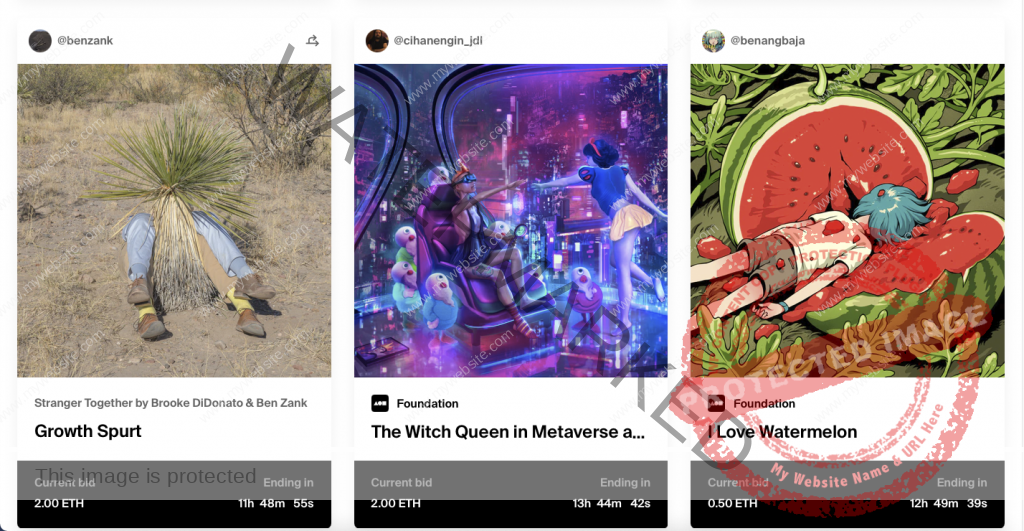

- Nifty Gateway is the first curated NFTs platform that has been created. This is an auction-based platform: there are daily drops of limited edition NFTs proposed by selected artists.

- Foundation is the first platform curated and managed by artists: Only the artists that have sold an NFT on this platform can invite other artists to be part.

- Artblocks is the first curated NFTs platform on a specific type of art: they are selling only Generative Art and it’s working very well.

- Aorist is the first NFTs platform managed as a gallery by an international cultural team that select complex artistic projects mixing visual art, poetry, technology and music, exploring different possibilities of the NFTs.

=> As we are still discovering the possibilities and uses of NFTs, we will probably see in 2022 new platforms focused on different artistic styles of these digital assets .

2- Coming of recognized contemporary artists into the NFTs Market:

Let’s see what happen when a well-known international artist, as Damien Hirst, enter the NFTs world. Hirst launched in June 2021 a very interesting experiment, called “Currency”. The idea was to explore if collectors were ready to massively adopt NFTs or if they would prefer traditional handmade artworks.

- In 2016, the artist painted 10.000 artworks with colorful dots patterns, called “Tenders”, each one annotated and signed.

- In June 2021, he offered 10.000 NFTs, each one corresponding to a physical artwork he created in 2016.

- Each NFT and physical print combination will be sold once, but here’s the twist — the buyers have 12 months to decide whether they wish to receive the physical artwork or the NFT.

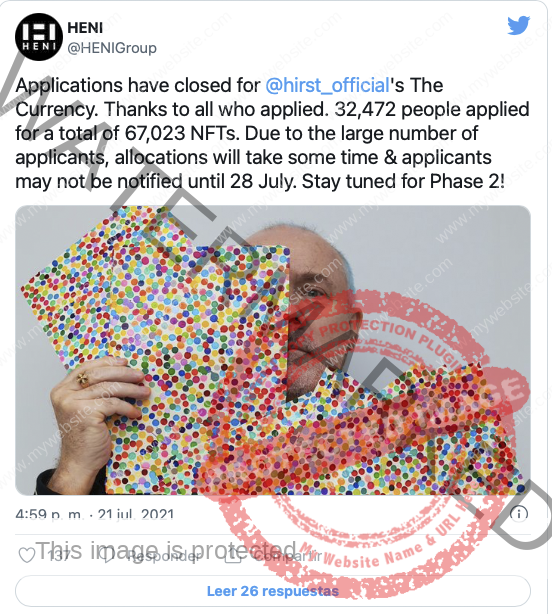

- There was an open application of one week, from 14 – 21 July 2021, with successful applicants able to buy an NFT for $2,000.

- The sales were organized by the prestigious Heni Group and they reported that 32,472 people applied for a total of 67,023 NFT…

- It was clear that the Demand was more than 6 times higher than the Offer, so there will be a speculative bubble on the NFTs created by Damian Hirst.

- The secondary marketplace for buying and selling Tenders has been open since 29 July. The first day of trading on the secondary market saw trading volumes of more than $1.3 million. The average sales price on this day was $7,128.

- Over the next 10 days (until 9 August), the volume of tenders traded averaged $395,173 per day with an average price of $8,379.

- By the end of August, the trading volume was $6 million in 24 hours. The price opened at $52,107 and closed at the end of the day at $63,114.

- From the 29 of July to the 13th September, (the 2,5 months the bubble of these specific NFTs has lasted), there have been 2,077 sales totaling $50,026,521.

=> Damian hisrt’s experiment have shown that collectors of “traditional artworks” are also interested in NFTs and are willing to pay them dearly if they are created by renowned artists.

=> The total dollar value traded on the NFTs secondary market has exceeded the initial drop value of $20 million.

=> The success of this experiment will show to innovative artists and galleries that the art market is changing and that they will have to introduce this new media (NFT) to their portfolio of creations to succeed.

3- Emergence of NFTs platforms curated by traditional galleries

For now, NFTs are present in different galleries of the Metaverse, like the 5 you can see in Cryptovoxels.

I wouldn’t be surprised if in 2022 we’ll see innovative galleries creating their own NFTs marketplaces, introducing emerging digital artists to their traditional clients.

If an innovative gallery could remove obstacles to its traditional customers by creating their digital wallets and letting them paying in dollars, (making the change from dollars to Ethereum), the clients would only have to choose the digital artists they like the most.

One of the first gallery to offer an internal NFTs marketplace to its traditional clients is the Heni Group that has created the secondary market for the Damian Hirt’s Tenders.

Another interesting project trying to bring the two worlds together (traditional art and NFTs) is blockchain.art, an online platform specialized in NFTs founded by a traditional artworks collector. The platform has been designed to work with traditional galleries and Museums.

4- Surfacing of new NFTs platforms not powered by Ethereum

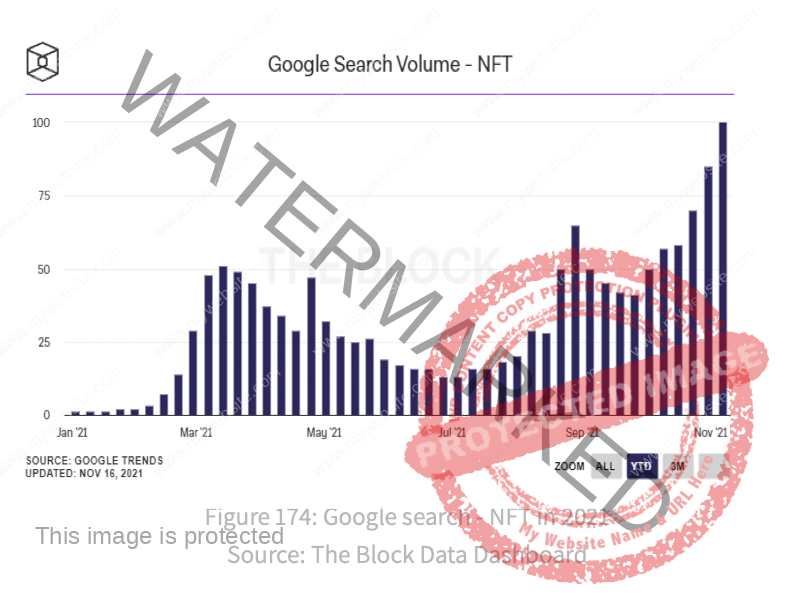

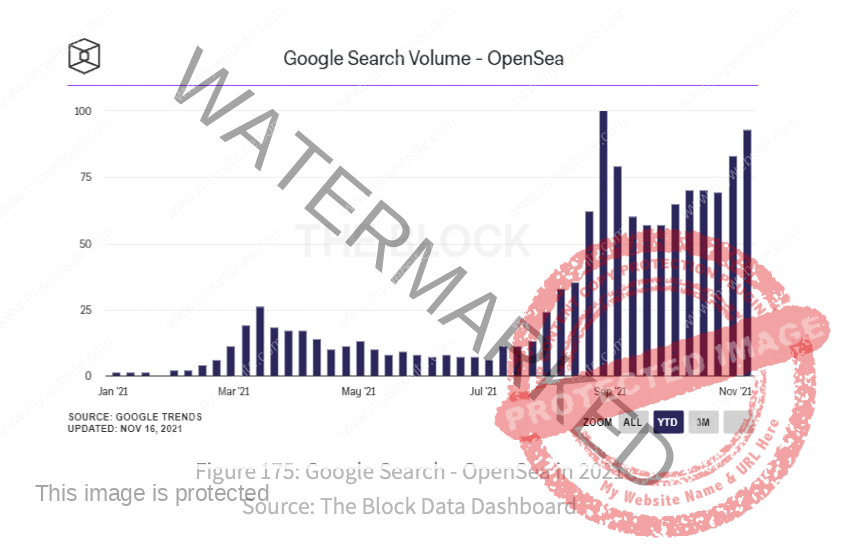

As we can see on these 2 charts, the Google search volume for “NFT” and “Opensea” have reached records from September to November 2021, demonstrating the growing public interest for these intangible digital assets.

So why in the meantime, NFTs sales dropped?

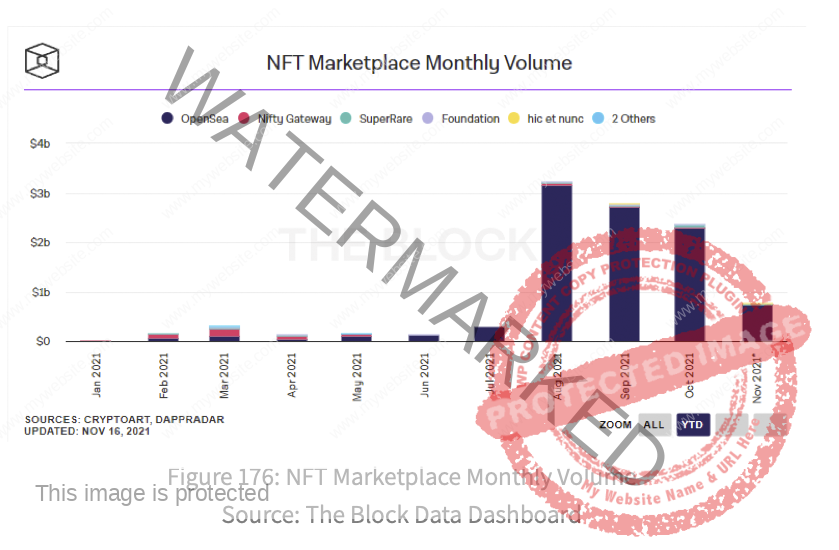

As explained in my previous post about NFTs, Opensea dominates the NFTs market: 88% of the sales of these digital assets have been made on this platform in 2021.

The NFTs you can trade on Opensea are powered by the Ethereum blockchain, and to create, sale or buy these NFTs, you have to pay “gas”. “Gas” refers to the cost necessary to perform a transaction on the network. Miners set the price of gas based on supply and demand for the computational power of the network needed to process smart contracts and other transactions.

As we can see on this chart, the “ETH gas” prices rose from 22$ in June to 198$ by the end of October 2021, multiplying by 10 the price of the transactions on the Opensea platform.

We can therefore deduce from these different curves that the price of transactions on the Ethereum blockchain can be a barrier to the adoption of NFTs by a large part of the public.

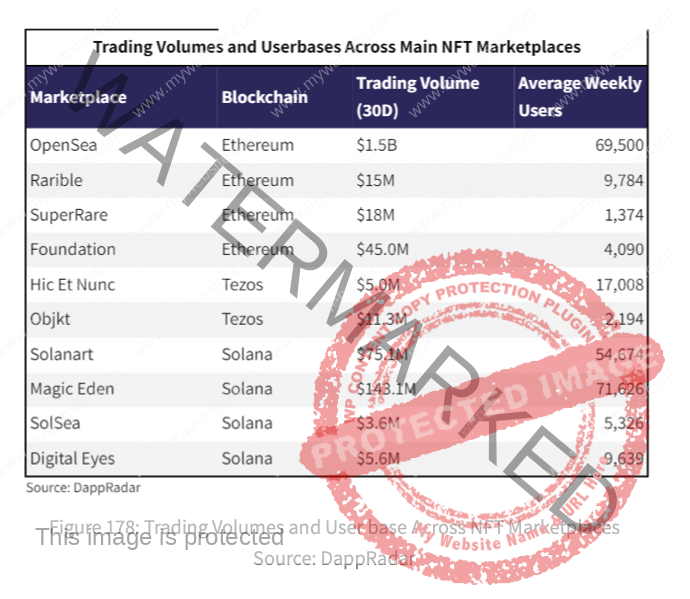

For this reason, in 2021 appeared the first platforms selling NFTs powered by other blockchains than Ethereum, like Solanart and Magic Eden powered by Solana, Hic et Nunc powered by Tezos and Aorist powered by Algorand.

=> So, if the “Ethereum gas” price keep high and growing, it’s likely that new platforms powered by other cryptocurrencies will appear in 2022.